Money Management App - Paisa Monito

Unified Payments Interface is an instant real-time payment system developed by the National Payments Corporation of India in 2016. With this, there was the introduction and the rise of payment with QR code scanning, and in came applications that offered payment to various services and friends. Since then, India has been seeing a decline in cash payments.

In the past, we had to use Excel sheets to track the savings spent, but now, with the integration of UPI and API Banking, tracking has become much easier, as seen with the rise of money management apps.

Project Overview

Discovering the problem statement

My friend and I were discussing this when it occurred to us that ever since college, we haven’t been very wise about spending money and have been scanning QR codes without making an effort to check our bank balance that often.

The reason could be laziness, the SMS summary feature that displays only the withdrawn amount, or the “password-protected check bank balance” feature in Google Pay that is listed at the bottom of the screen, which doesn’t catch our eye. This is when we came up with the idea of building a money management application that alerts us of our bank balance and tries to limit the amount that can be spent each month.

Empathize

To get started with user research, we sent a questionnaire to understand how users' spending habits. These were the responses.

Most used applications for payments

Question: Are you able to keep track of your spending?

Some of the applications the users used to monitor spending habits were: Notion, Splitwise, GoDutch, Wallet, and Spreadsheet.

Next, we wanted to know the categories in which they spent more amount

Question: On what do you spend the most?

The last question was an open-ended one, what are the ways in which you’d like to monitor your spending habits?

These were some of the responses:

After which I came up with a user persona and empathy map

Define

Based on the answers in the questionnaire, we went back to our initial ideas to refine them. We tried to understand, how we could help the money management process and why would users choose our solution? This is when we thought of a feature, which was mentioned in one of the responses to the questionnaire:

An application that would manually allow me to fill in different categories I could spend on and how much I’ve spent per day under each category, and could analyse a few months’ worth of data filled in, and tell me in which areas I tend to spend more in general so I could keep a track of it

Based on this and further brainstorming, we decided on some features of the application to start with:

-

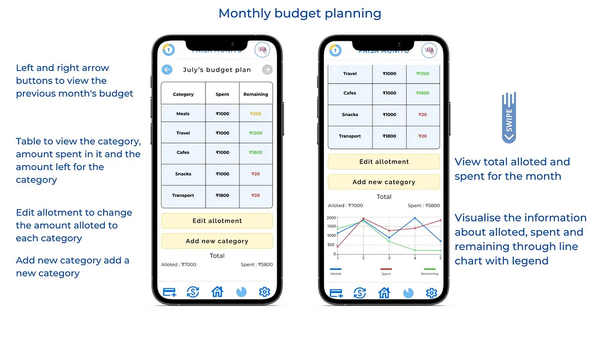

Track spending habits through graphs and visual aids so that user can understand their patterns better.

-

Provide a feature to list down different categories and limit the amount spent across categories.

-

Give users alert notifications if they are close to the limit and might exhaust the amount soon.

-

Try to store the data of the users locally so that they aren’t worried about their privacy ( the idea came from Obsidian, a note-taking app that Ritesh uses that works with local markdown files ).

-

Try to parse SMS instead of accessing bank details

Prototype

Feedback on the wireframes :

-

Categories could be a droplist instead of a swipe bar.

-

The account balance could be added to the transactions page

-

The doughnut chart needs to have labels

Branding